Safeguard Your Animals With Tailored Risk Security Insurance Coverage

Customized danger defense insurance policy supplies an extensive solution to guard your animals versus unpredicted circumstances that could jeopardize your livelihood. In this conversation, we will certainly discover the details of customized danger protection insurance, delve right into the advantages of personalized coverage, highlight usual threats covered by customized policies, and offer useful ideas for choosing the right insurance to secure your animals financial investments.

Comprehending Tailored Risk Defense Insurance Policy

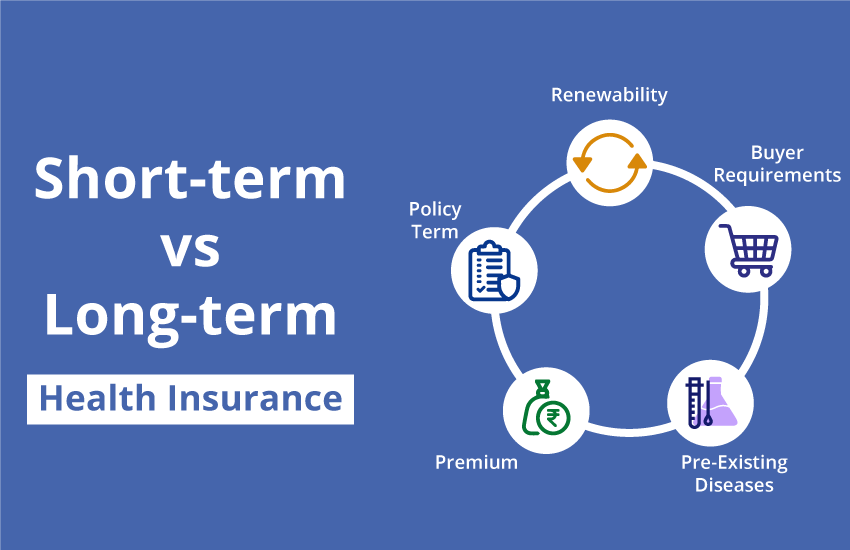

Tailored Threat Security Insurance gives tailored coverage for particular dangers faced by people or businesses, providing a customized approach to taking care of possible losses. This sort of insurance permits insurance policy holders to customize their protection to resolve the special risks they run into, supplying a level of defense that is particularly developed to satisfy their requirements. By working closely with insurance policy service providers to recognize and prioritize the dangers most relevant to their procedures, insurance policy holders can ensure that they are adequately secured versus prospective risks.

Tailored Threat Protection Insurance coverage varies from standard insurance coverage by permitting for a more customized and flexible technique to risk administration. Rather than going with a one-size-fits-all remedy, insurance policy holders can choose the specific coverage choices that line up with their danger tolerance and monetary direct exposure. This customization allows organizations and people to concentrate their insurance coverage where it is most required, guaranteeing that they are not spending for unnecessary security while still protecting against substantial risks. By tailoring their insurance coverage, insurance policy holders can get better satisfaction recognizing that they are adequately secured in areas that matter most to them.

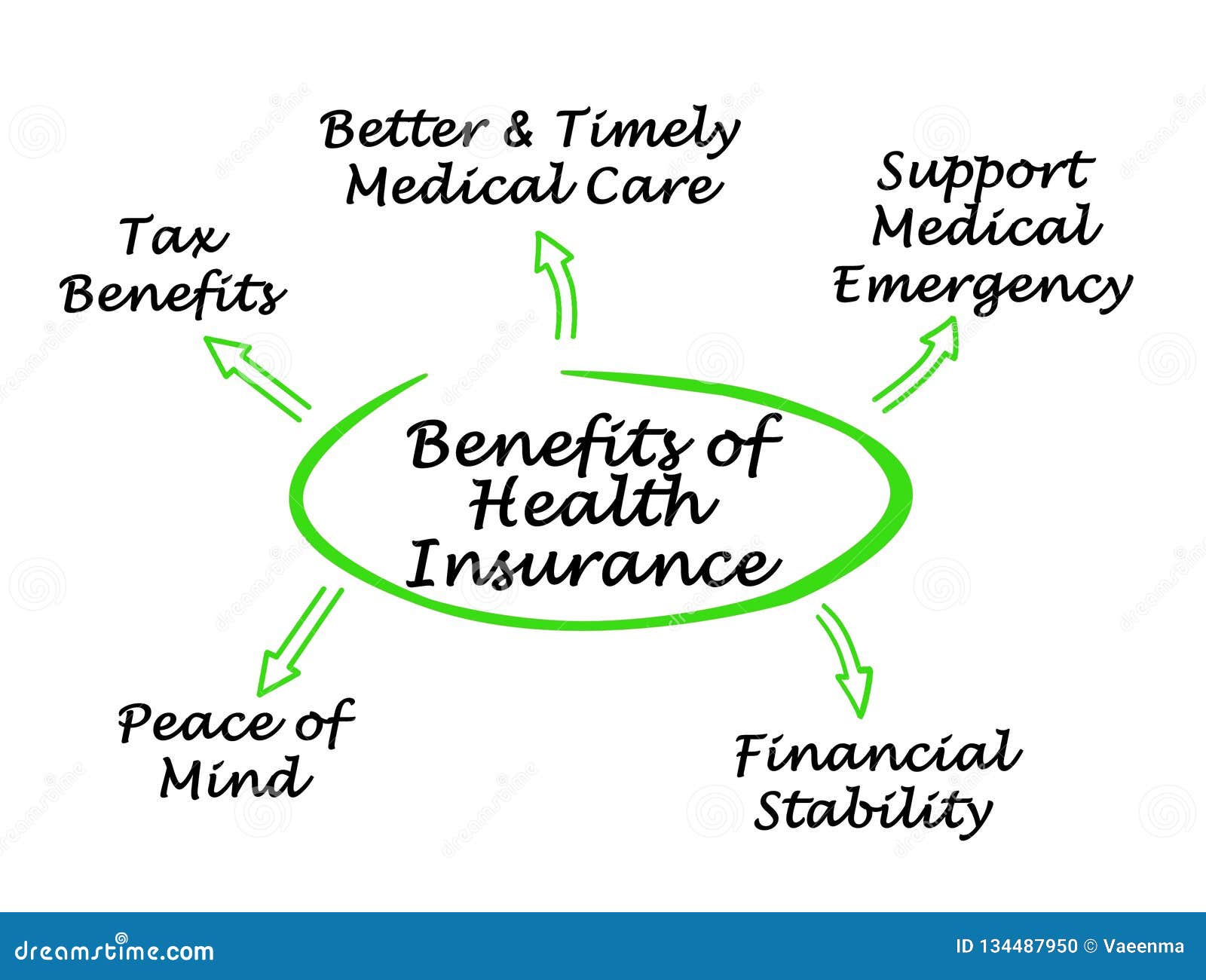

Advantages of Personalized Insurance Coverage

When people or companies choose tailored insurance coverage, they get a critical advantage in managing their particular dangers successfully. Customized insurance coverage offers customized solutions that match the unique demands of the insurance policy holder, giving a much more comprehensive and specific degree of defense. One of the crucial benefits of personalized coverage is that it permits for the addition of specific dangers that pertain to the specific or service, guaranteeing that they are sufficiently protected in situation of unforeseen occasions.

Moreover, personalized insurance coverage typically causes price financial savings by eliminating unneeded coverage that might be included in common insurance policies. By concentrating just on the threats that pertain to the policyholder, they can optimize their insurance policy investment and allocate sources a lot more successfully (Bagley Risk Management). Additionally, customized insurance coverage can give comfort, understanding that the policy is created to attend to the certain susceptabilities encountered by the insured event. On the whole, the advantages of tailored insurance coverage prolong past simple monetary security, providing an all natural danger administration technique that aligns with the distinct circumstances of the insured entity.

Variables to Think About for Animals Insurance Policy

To make enlightened choices relating to livestock insurance, it is necessary for individuals or organizations to carefully examine vital aspects that can influence the coverage and security of their livestock assets. One critical variable to take into consideration is the sort of livestock being guaranteed. Different species such as livestock, chicken, or swine may have differing insurance coverage needs based upon their value, sensitivity to conditions, and other threats.

Another vital variable is the location of the livestock. The geographical area where the pets are maintained plays a substantial duty in identifying the possible risks they deal with, such as all-natural catastrophes or prevalent illness in that location. Recognizing these local dangers aids in selecting appropriate coverage choices.

Furthermore, the size of the livestock operation and the number of animals involved need to be visit this website thought about. Larger procedures with even more livestock might require higher coverage limits and different policy frameworks compared to smaller-scale procedures. Examining these variables in information can aid in tailoring a livestock insurance plan that provides appropriate defense customized to the specific requirements of the service or individual.

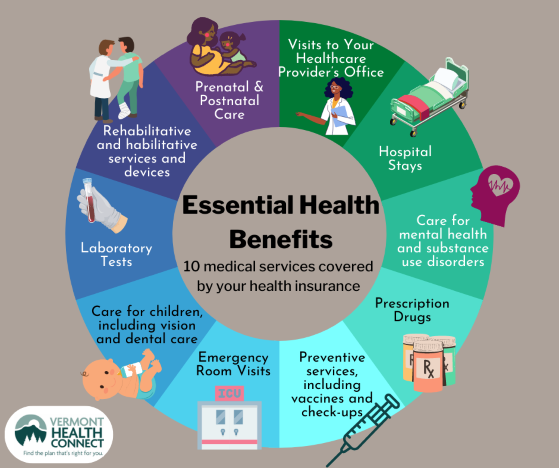

Usual Threats Covered by Tailored Plans

Recognizing the specific dangers connected with animals assets and their environment is extremely important in determining the insurance coverage needed in tailored insurance plan. Tailored threat security insurance policy generally covers an array of usual dangers that can affect animals procedures. These policies usually consist of protection for risks such as condition episodes, all-natural catastrophes (such as wildfires, cyclones, and floodings), theft, and accidental fatality of livestock. Condition break outs, such as foot-and-mouth illness or bird influenza, can devastate animals populaces and cause considerable economic losses. Tailored plans can offer payment for the loss of pets as a result of these break outs. Natural catastrophes position a continuous threat to animals operations, and having insurance policy coverage can aid mitigate the economic influence of property damage and loss of animals. In addition, burglary is a threat that animals owners face, and insurance coverage can provide reimbursement for taken pets. Accidental fatality protection ensures that losses due to unpredicted occasions are covered, offering peace of mind to animals owners in the face of unexpected catastrophes. Customized plans are made to deal with these usual dangers and give detailed protection for animals properties.

Tips for Picking the Right Insurance Coverage

In the process of picking proper livestock threat protection insurance, it is vital to meticulously analyze your specific needs and risks - Bagley Risk Continued Management. To select the right insurance coverage for your livestock, beginning by examining the kinds of pets you possess, the potential dangers they deal with, and the financial impact of those risks. Take into consideration elements such as the place of your farm, the frequency of illness in your location, and the value of your livestock

When comparing insurance plan, seek protection that straightens very closely with your individual circumstances. Read the policy that site details thoroughly to recognize what is covered, what is excluded, and the restrictions of the protection. It's also vital to analyze the credibility and financial security of the insurance service provider to guarantee they can meet their commitments in instance of a claim.

In addition, choose insurance coverage companies that offer versatile options and outstanding client service. When you require it most, a knowledgeable and responsive insurance firm can assist you navigate the intricacies of animals insurance and give support. By taking these factors to consider into account, you can make a notified decision and safeguard your livestock effectively

Conclusion

In this discussion, we will check out the intricacies of customized risk protection insurance, delve into the advantages of customized protection, emphasize typical risks covered by tailored plans, and offer beneficial tips for picking the ideal insurance to shield your animals financial investments.